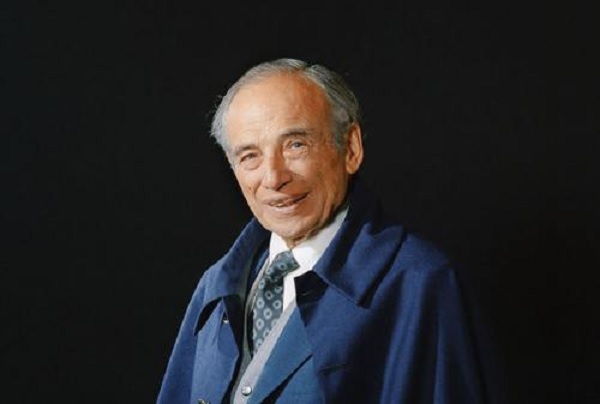

Benjamin Graham, often referred to as the "father of value investing," laid out numerous principles and strategies that have influenced many successful investors, including Warren Buffett. His seminal works, "Security Analysis" and "The Intelligent Investor," provide a comprehensive guide to investing with a focus on minimizing risk and finding undervalued securities. Here are some key tips from Benjamin Graham's investment philosophy:

1. Margin of Safety

One of Graham's core principles is the concept of the margin of safety. This means buying securities at a significant discount to their intrinsic value. By doing so, you provide a buffer against errors in your analysis or unforeseen market downturns. The margin of safety helps protect your investment and increases the potential for higher returns.

2. Intrinsic Value

Graham emphasized the importance of determining the intrinsic value of a security, which is the true worth based on an analysis of its fundamentals. This involves evaluating a company's assets, earnings, dividends, and growth potential. Investors should buy stocks trading below their intrinsic value, providing a greater chance of profit as the market eventually recognizes the stock's true worth.

3. Focus on Fundamentals

Graham advised investors to focus on the fundamentals of the companies they are investing in. This includes analyzing financial statements, understanding the business model, and assessing the management's competency. Key metrics to consider are earnings per share (EPS), price-to-earnings (P/E) ratio, book value, and dividend yield.

4. Diversification

To mitigate risk, Graham recommended diversification. By spreading investments across a variety of stocks, industries, and asset classes, investors can reduce the impact of a poor-performing security on their overall portfolio. He suggested holding a diversified portfolio of 10 to 30 stocks.

5. Invest with a Long-Term Perspective

Graham believed in investing with a long-term perspective. He argued that the stock market is often driven by short-term speculation and emotions, but in the long run, it reflects the true value of companies. By staying patient and avoiding the temptation to react to market volatility, investors can achieve more stable and substantial returns.

6. Avoid Speculation

Graham warned against speculation, which involves making high-risk investments based on market trends or short-term movements. He advocated for a disciplined approach to investing, where decisions are based on thorough analysis and sound reasoning rather than market hype or rumors.

7. Mr. Market

Graham introduced the allegory of Mr. Market to illustrate the irrational behavior of the stock market. Mr. Market is an emotional character who offers to buy or sell stocks at different prices every day. Sometimes, his prices are reasonable, and other times they are not. Graham suggested that investors view market fluctuations as opportunities to buy undervalued stocks or sell overvalued ones, rather than being influenced by Mr. Market’s mood swings.

8. Defensive vs. Enterprising Investors

Graham differentiated between defensive and enterprising investors. Defensive investors prefer a more passive approach, focusing on low-risk, stable investments like blue-chip stocks or bonds. Enterprising investors, on the other hand, are willing to put in more time and effort to find undervalued stocks and are prepared to take on more risk for potentially higher returns. Each investor should choose a strategy that aligns with their risk tolerance and time commitment.

9. Quality of Earnings

Graham stressed the importance of the quality of earnings. Investors should look beyond the headline earnings numbers and consider how sustainable and reliable those earnings are. This involves analyzing the sources of earnings, such as recurring revenues versus one-time gains, and assessing whether the earnings are being supported by genuine business growth.

10. Avoid Overpaying

A fundamental rule in Graham's philosophy is to avoid overpaying for investments. Even a great company can be a poor investment if bought at too high a price. Investors should be disciplined in their valuation approach and be willing to wait for the right price before buying.

Practical Application: The Graham Number

One of the practical tools derived from Graham's teachings is the Graham Number, a conservative estimate of a stock's fair value. It is calculated as:

Graham Number

![]()

This formula helps investors quickly assess whether a stock is undervalued based on its earnings and book value.

Benjamin Graham's investment principles are timeless and provide a solid foundation for building a successful investment strategy. By emphasizing intrinsic value, a margin of safety, fundamental analysis, and a disciplined approach, investors can make informed decisions that minimize risk and enhance long-term returns. Whether you are a defensive or enterprising investor, applying Graham's teachings can help you navigate the complexities of the stock market with greater confidence and success.